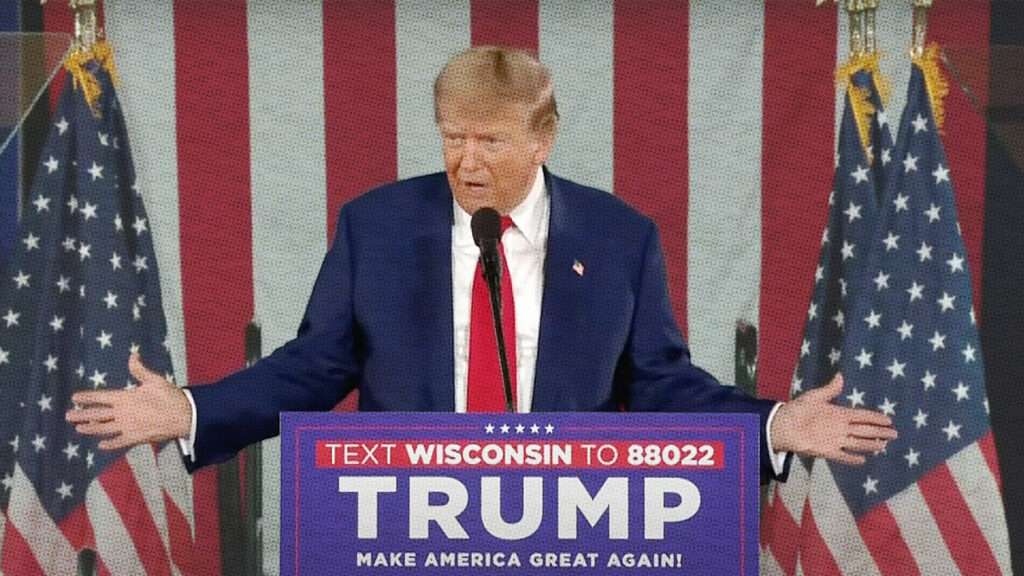

President Biden expressed his opposition to the proposed takeover of U.S. Steel by Japan’s Nippon Steel at a campaign event in Pennsylvania. He emphasized the importance of keeping United States Steel under American ownership. The timeline for the acquisition remains uncertain, with U.S. Steel expecting the deal to be completed in the second half of the year, pending regulatory approvals.

Nippon Steel has delayed the closing of the deal to the end of 2024 due to requests for additional information from the Department of Justice, which is reviewing the transaction.

The scrutiny of the acquisition has raised concerns that the Biden administration may block the $15 billion buyout. The Committee on Foreign Investment in the United States (CFIUS) could play a crucial role in determining the fate of the merger, given its authority to assess national security implications of such deals.

CFIUS, established in the 1970s, has evolved to address a wide range of national security concerns, including technology and supply chain vulnerabilities. The panel’s decision on the U.S. Steel acquisition will be closely watched, especially given the historical context of similar transactions involving foreign entities.

The current situation echoes the tensions of the 1980s, particularly concerning trade with Japan. A previous attempt by Nippon Steel to acquire a U.S. metals business was thwarted by CFIUS over national security concerns related to technology transfer to potential adversaries.

Unlike past cases involving Chinese investments, the focus now is on preserving American control over critical industries like steel manufacturing. The Biden administration’s emphasis on supply chain resilience post-pandemic adds another layer of complexity to the decision-making process.

CFIUS has been granted expanded powers over the years to address emerging threats and safeguard national interests. The review process for the U.S. Steel acquisition will involve considerations of job protection, domestic production, and potential national security risks.

As the Biden administration navigates this complex issue, the outcome of the deal remains uncertain. The balance between economic interests, national security concerns, and political considerations will ultimately shape the decision-making process surrounding the acquisition.

The fate of U.S. Steel and its potential acquisition by Nippon Steel hangs in the balance as regulatory reviews and political dynamics come into play. The outcome of this high-stakes deal will have far-reaching implications for the American steel industry and the broader economic landscape.