Commentary

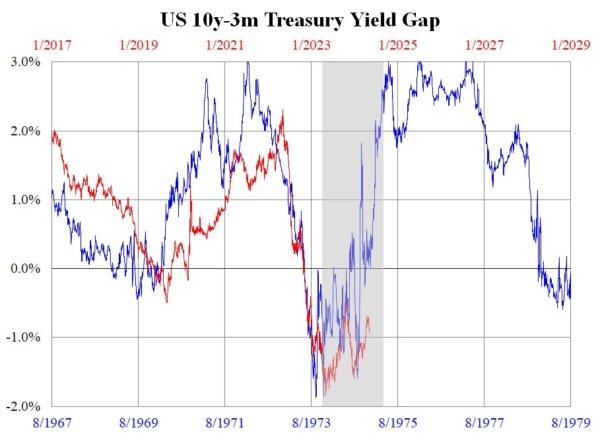

Last year, the discussion revolved around the predictability of a recession based on the yield curve. Historically, a yield curve inversion has often preceded a recession by 1.5 to 2 years, although there is no consensus among academics regarding this specific timeframe. Similarly, the effectiveness of monetary policy is also a topic of debate, with economic theories providing the mechanism but the exact duration of impact being purely empirical. Academics tend to shy away from making definitive statements on such matters due to the considerable variation in outcomes.

However, understanding the timing of economic events is crucial, especially for central bankers who formulate policies with a target timeframe in mind. Despite the uncertainty surrounding these predictions, central bankers must navigate through the complexities of economic data to make informed decisions.

The uncertainty surrounding yield curve predictions is further compounded by the interplay between short- and long-term yields. While short-term yields are closely tied to policy rates, long-term yields are influenced by macroeconomic factors and market forces, making them less predictable. The inversion of the yield curve is often accompanied by rapid rate hikes, and the time it takes for these tightening measures to impact various sectors is what determines the potential onset of a recession.

A comparison of the yield gap between the present day and nearly half a century ago reveals similarities in inversion patterns. However, the context differs significantly, with changes in interest rates and economic composition shaping the current landscape. Despite these differences, weaknesses in one sector are likely to affect the other eventually, reinforcing the predictive power of the yield curve inversion.