Commentary

Asian currencies have recently seen a significant depreciation, particularly led by the Japanese Yen (JPY) against the strong U.S. dollar. The focus on JPY is due to its near-zero interest rates, making it vulnerable to depreciation. This depreciation has had a ripple effect on other Asian currencies as well. With concerns about China’s economic troubles, there is speculation about the possibility of another Asian crisis.

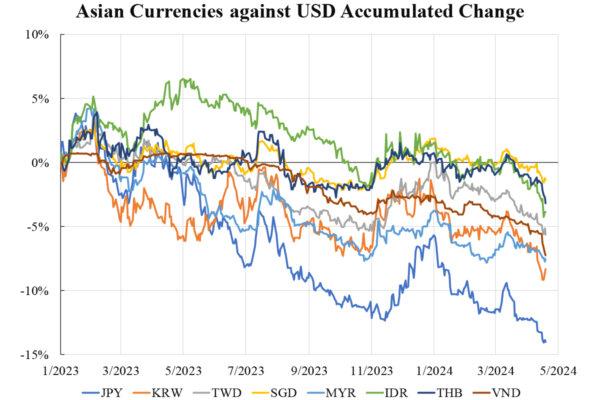

Examining the severity of the Asian currency depreciation, a chart displaying the performance of eight major Asian currencies against the U.S. dollar since the beginning of 2023 is shown. The data is analyzed with the dollar index (DXY) staying relatively stable, indicating the Asian currency performance in a stable dollar environment.

While JPY experienced a significant depreciation, other Asian currencies faced an initial depreciation in Spring 2023 followed by stability until Spring 2024. There are indications of a potential new depreciation trend, but the magnitudes are within normal market movements rather than indicative of a crisis. The likelihood of an Asian crisis II is uncertain, but it can be inferred from the economic strengths between the East and West driving capital flow.

With China’s influence waning, Asia’s main driver is now export business. The strength of Western import demand and production line movements will determine the likelihood of a crisis. While the potential threats of global inflation and production easing exist, indicators suggest a lower impact compared to past crises.

Factors such as production easing leading to capital outflow and currency depreciation pose threats, but current indicators suggest a lower impact compared to past crises.

Please rewrite the following sentence:

“The cat chased the mouse around the house.”

“The mouse was chased by the cat throughout the entire house.”

Source link