Business failures have reached a post-pandemic peak, matching the rate seen in October 2020, with the food and beverage industry being the most affected.

Australian businesses are experiencing a level of failure not seen since the peak of the pandemic lockdowns in October 2020. While all sectors are feeling the impact, the food and beverage services have been hit the hardest, according to the October Business Risk Index (BRI) from CreditorWatch.

Over the last 18 months, annualized insolvency rates have more than doubled, surpassing pre-COVID levels by approximately 25 percent.

Court actions have also risen significantly above pre-COVID levels as major creditors like banks and the ATO are seeking to recover debts. The number of cases increased by 13 percent from August 2023 to August 2024.

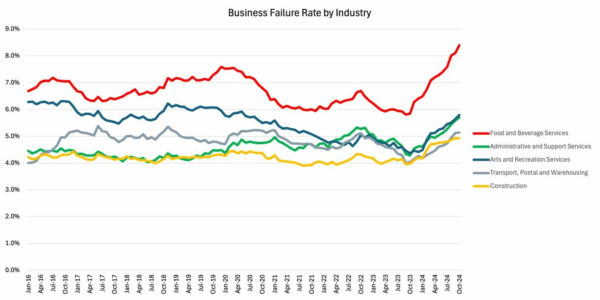

The average failure rate across all sectors currently stands at 5.04 percent of total businesses, up from 3.97 percent in October of the previous year.

The previous peak was 5.08 percent, recorded in October 2020 during the height of the COVID-19 pandemic. After an initial decline following the pandemic, the failure rate began to rise again in October 2023.

The food and beverage sector reported the highest failure rate among all industries in the recent study, rising to 8.5 percent on a rolling 12-month basis, up from 8.3 percent in the previous 12 months up to September.

CreditorWatch predicts that the failure rate in the sector over the next 12 months will continue to rise to 9.1 percent.

During challenging financial times, consumers tend to shift their spending from higher-end restaurants to more affordable options.

Data Broken Down

Household spending data for September from the Australian Bureau of Statistics (ABS) revealed that visits to hotels, cafes, and restaurants across all price points were 1.7 percent lower than a year ago.

Sales in the tobacco and alcohol sector were even weaker, down by 16.6 percent year-on-year in volume terms.

Administrative and support services ranked second with a 6 percent failure rate, followed by arts and recreation services (5.9 percent) and transport, postal, and warehousing (5.8 percent).

There is a potential positive sign as the failure rate in construction (5.3 percent) may be stabilizing.

Failures are higher than pre-COVID levels in construction, administrative and support services, and food and beverage services. The challenges in the food service and construction sectors have persisted for some time.

Data source: ASIC database direct link, CreditorWatch industry data; business failure rate defined as voluntary and involuntary administrations, ASIC strikeoffs, and voluntary business deregistrations. CreditorWatch

In addition to tough economic conditions and higher costs for businesses, CreditorWatch highlights that many are struggling due to the Australian Taxation Office (ATO) resuming collection activities to recover about $35 billion owed by small businesses, which will likely lead to more stress and insolvencies in the foreseeable future.

The food and beverage industry leads in outstanding ATO tax debts, with 1.8 percent of companies in that sector having debts exceeding $100,000.

CreditorWatch currently has 28,780 records of businesses with overdue tax debts of over $100,000, with sole traders accounting for nearly half (14,216) of these.

Data from the Australian Taxation Office. CreditorWatch

The food and beverage, construction, arts and recreation services, and transport, postal and warehousing industries tend to have a significant portion of their costs allocated to wages, making them particularly vulnerable to relatively high national minimum wage increases.

Confidence Increasing

The Chief Economist of the company, Ivan Colhoun, notes that the impact of the July 1 tax cuts is not yet clear but believes they will alleviate some of the pressures on consumers and businesses.

He also mentions that despite inflation increases appearing to have peaked, businesses are eagerly awaiting interest rate relief.

CreditorWatch CEO Patrick Coghlan emphasizes the need for interest rates to decrease to provide relief to households and encourage increased spending.

Regions with the highest risk were identified as Western Sydney and South-East Queensland.

Among the capital city CBDs, Adelaide has the lowest forecasted failure rate at 5.1 percent, followed by Perth (5.2 percent), Melbourne (5.8 percent), Brisbane (5.9 percent), and Sydney (6.2 percent).

Please rewrite this sentence.

Source link