Monday, April 15 is Tax Day, a dreaded day for many American adults. Each year, taxpayers gather all necessary income statements and receipts in hopes of reducing the amount they owe to the government.

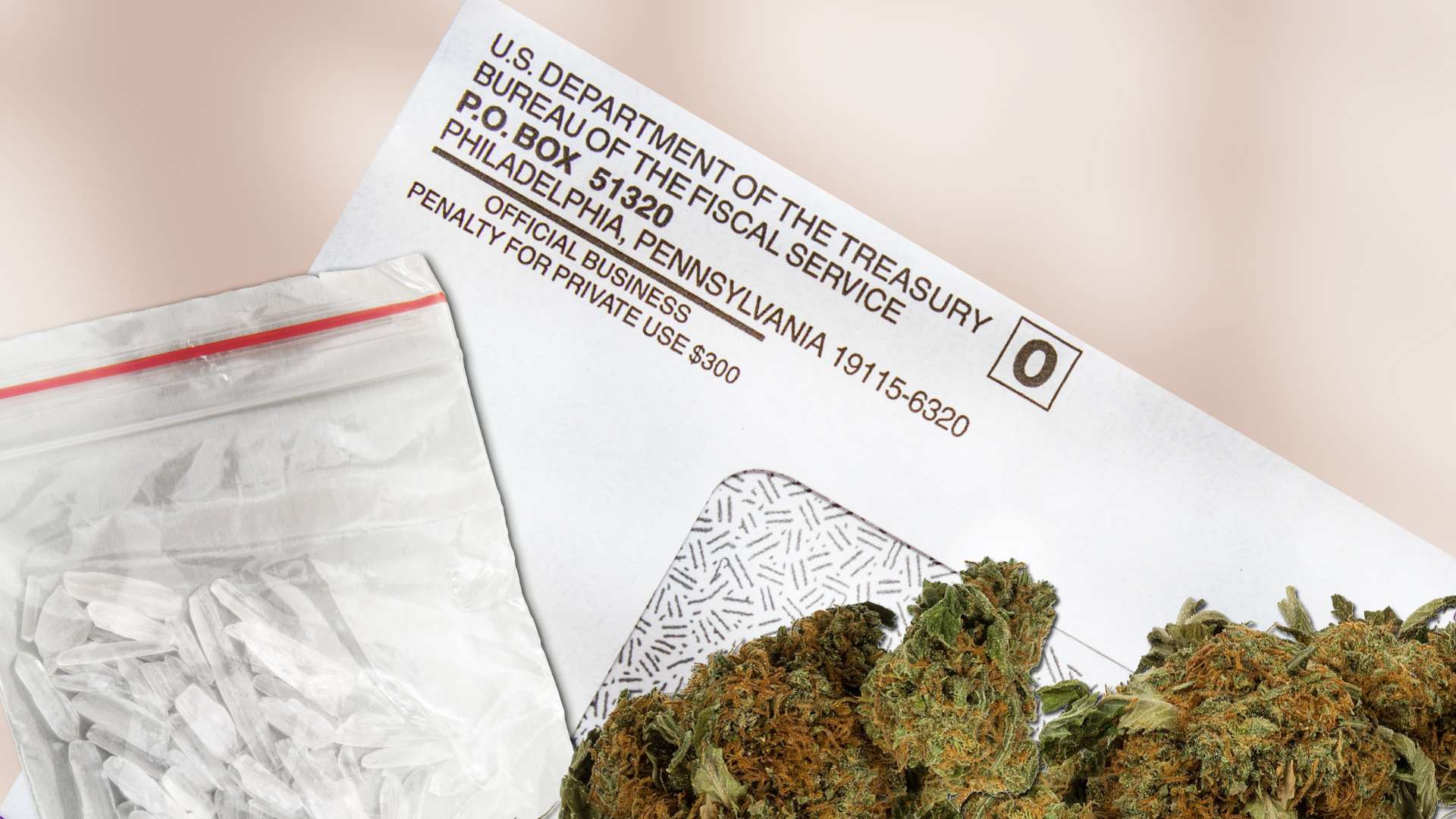

The IRS reminds taxpayers that income from illegal activities such as stealing, selling drugs, or accepting bribes is still taxable.

According to last year’s statistics, Americans spent 6.5 billion hours on tax preparation, resulting in $260 billion in lost productivity. On top of that, $104 billion was spent on direct tax filing costs.

The complexity of the tax law, including deductions and taxable revenue types, contributes to the difficulty of tax filing.

IRS Publication 17 provides guidelines for filing federal income tax returns. The IRS advises that income from illegal activities must be reported on the appropriate tax forms.

Even income from illegal activities such as selling drugs or stealing property is expected to be reported and taxed by the IRS.

While returning stolen property may not prevent prosecution for theft, the IRS will still require reporting of its fair market value as income.

The IRS’s advice highlights the complexity and absurdity of the tax code, including the need to keep records indefinitely for certain situations.

Failure to report income, filing fraudulent returns, or engaging in illegal activities can result in IRS action with no statute of limitations.

Lessons from history, such as Al Capone’s conviction for tax evasion, serve as reminders of the consequences of not properly reporting income.

Reporting income and maintaining tax records can prevent legal issues in the future, as demonstrated by Capone’s case.