Happy Tuesday and welcome to another edition of Rent Free.

Last week, this newsletter offered a mostly negative assessment of both major presidential candidates’ first-term housing records and likely plans for their second. In the past couple of days, things have managed to go from bad to worse on both sides of the aisle.

On Monday, former President Donald Trump selected Sen. J.D. Vance (R–Ohio) to be his running mate.

Vance is an outspoken protectionist, nationalist, and anti-corporate hawk who’s bound to shift any future Trump administration in an anti-trade, anti-immigration, and anti-market direction. That can only mean bad things for the cost and availability of housing.

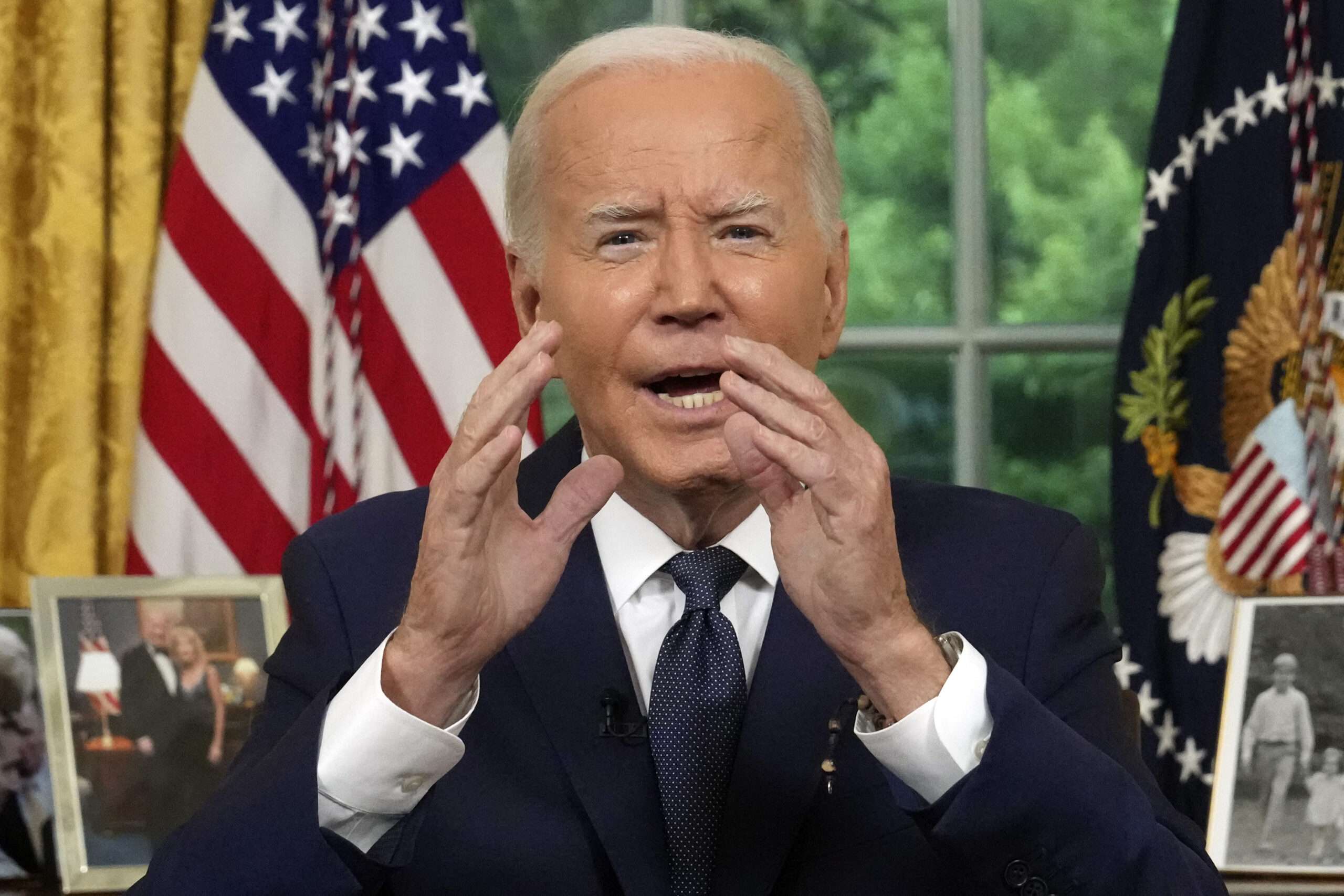

And today, President Joe Biden is expected to lay out a plan for federal rent control—a policy with a well-documented history of killing new supply that could undermine all the progress local and state governments have made liberalizing land use regulations.

So, at the risk of depressing readers, this week’s newsletter will be another grim look at how both national parties are moving, in their own ways, in a markedly anti-market direction and all the negative implications that will have for housing policy.

Joe Biden’s Radical Rent Control Plan

Yesterday, The Washington Post broke the news that Biden plans to unveil a nationwide rent control during a campaign stop in Nevada.

“Rent is too high and buying a home is out of reach for too many working families and young Americans,” said Biden in a statement released this morning. “Today, I’m sending a clear message to corporate landlords: If you raise rents more than 5% on existing units, you should lose valuable tax breaks.”

Want more on urban issues like regulation, development, and zoning? Sign up for Rent Free from Reason and Christian Britschgi.

Biden has been dropping supportive comments about rent control for a few weeks now, so his more explicit, articulated endorsement of the policy isn’t necessarily a surprise.

It is nevertheless a radical move. The federal government hasn’t regulated rents at private buildings since World War II. There’s a good reason for that. A mountain of economic evidence suggests rent control is a terribly counterproductive policy.

The research couldn’t be clearer that where rent control policies suppress rents, they also suppress the supply of rental housing (by reducing construction or encouraging conversion of rental units to for-sale units) and reduce the quality of rental housing (by limiting investment).

The people who get a rent-controlled unit pay lower prices and stay in their units longer. The people who don’t get a rent-controlled unit end up paying higher prices. Cities as a whole suffer from declining investment and economic growth.

A rent control policy adopted in St. Paul, Minnesota, saw an exodus of developers from the city. New York City’s long-standing “rent stabilization” policy is producing vacant, dilapidated buildings that no one has the money to fix or redevelop.

Telling Exceptions

Biden himself seems to be conceding that rent control produces many of the problems it seeks to solve. Rather than abandoning the policy, he’s instead decided to riddle his rent regulation scheme with carve-outs and exceptions.

Some of these exceptions may well limit the damage his proposal would do. They also make it a confusing, arbitrary mess that would award benefits to a near-random collection of renters.

Details of the new proposal are slight, but the Post reports that the president’s plan would require landlords who own 50 or more units to cap annual rent increases at 5 percent for two years or lose an unspecified “tax benefit.” These limits would not apply to new construction.

These provisions limit the number of units that would fall under rent control. That’s good. But they compound rent control’s long-standing problem of being poorly targeted.

It’s hard to say why someone who rents from a landlord who owns 50 units of housing should have their rent capped, but someone who rents from a landlord who owns 49 units shouldn’t. The same can be said for Biden’s new construction exemption. If one thinks rent control is a good idea, why should only people who live in older construction benefit?

The Post‘s reporting doesn’t mention Biden’s plan including any sort of income eligibility limits, which is typical of most rent control policies.

That means that higher-income renters with the ability to absorb a rent increase could get protection because they rent from a large landlord, while lower-income tenants renting from a smaller landlord won’t.

Going to Congress???

The people familiar with Biden’s rent control plan who talked to the Post said it’ll need approval from Congress.

That comment is a relief. It’s a rare concession from the Biden administration that the separation of powers is a real thing. As an added silver lining, it suggests that Biden perhaps is not particularly serious about actually capping rents.

Biden has frequently stretched his executive authority to impose any number of progressive policies like student loan forgiveness and medical debt forgiveness.

Just this past week, the independent Federal Housing Finance Agency (FHFA) announced they’d require owners of multifamily properties with Freddie Mac and Fannie Mae-owned mortgages to adopt a string of tenant protections. Those include giving 30 days’ notice of rent increases, 30 days’ notice of expiring leases, and a five-day grace period for late rent payments.

As a policy matter, those are incredibly modest tenant protections. As a legal matter, they represent an incredibly expansive view of FHFA’s power to tell Fannie and Freddie what to do, says Mark Calabria, the former FHFA director under President Donald Trump.

FHFA was created in 2008 to act as conservator of Freddie Mac and Fannie Mae, and get the government-sponsored enterprises back on sound financial footing.

By requiring Fannie and Freddie to adopt those tenant protections, the agency is asserting its conservatorship powers allow it to force those government-sponsored enterprises to adopt whatever policies it thinks wise.

“I’m very much of the view that really broad policy changes that have nothing to do under the conservatorship can’t be done under the conservatorship,” says Calabria. “It’s extremely weak legal authority.” He compares it to the judge overseeing Hertz’s bankruptcy requiring the rental car company to only rent out electric cars.

Tenant advocates and progressive Democrats have been pushing the Biden administration to use FHFA to cap rents at Fannie and Freddie-financed properties.

By forcing Fannie and Freddie to adopt minimal tenant protections, the Biden administration is essentially saying that it has the legal authority to require the companies to adopt rent control as well. By not requiring them to adopt rent control, his administration is implicitly conceding it doesn’t think that’s a wise and/or politically practical idea.

A Bad Message

The fact that Biden is unveiling a rent control plan so late into his administration while also putting the onus on Congress to act on it suggests the idea is more a messaging stunt to revive a flagging campaign than a real policy the president is actually eager to fight for.

Even if that’s the case, that should provide cold comfort to rent control critics.

The president has enormous informal power to set the tone for policymaking. One would hope he’d use that influence to promote productive policies and condemn counterproductive ones.

Instead, Biden is putting the prestige of his office behind the repeatedly discredited idea that housing can be made more ample and affordable through government-imposed price controls.

Prominent moderate liberals are aghast at Biden’s rent control plan.

“Rent control has been about as disgraced as any economic policy in the tool kit. The idea we’d be reviving and expanding it will ultimately make our housing supply problems worse, not better,” said Jason Furman, the Obama administration’s top economic advisor, told the Post.

“This kind of cap would lead to less affordable housing being built and substantially increase hosting costs,” said Colorado Gov. Jared Polis on X.

This kind of cap would lead to less affordable housing being built and substantially increase hosting costs https://t.co/t8vkObEI1a

— Jared Polis (@jaredpolis) July 15, 2024

They’re right to be worried. Today’s half-serious campaign promise can become tomorrow’s enacted policy. Anyone familiar with rent control’s record should be very concerned about Biden’s endorsement of the policy.

The Housing Policy Implications of Vice President J.D. Vance

Things are not looking much brighter on the Republican side of the aisle following the news that Trump has selected Sen. J.D. Vance (R–Ohio) to be his running mate.

Vance is an outspoken “national conservative” who has little time for traditional Republican commitments to free markets and free trade.

As my colleague Stephanie Slade wrote yesterday, Trump’s selection of Vance as the vice presidential candidate marks a doubling down on his “America First” policy agenda.

The best thing one can say about Trump picking Vance is that the Ohio senator will do nothing to balance out all of Trump’s ideas for making housing more expensive.

Trade and Immigration

For starters, Vance is an arch-protectionist who’s endorsed Trump’s call for 10 percent tariffs across the board. Slapping taxes on imported materials needed for housing construction would make the costs of construction higher, lower housing production, and ultimately raise costs for consumers.

The Republican Party’s 2024 platform calls for deporting immigrants as a means of making housing more affordable.

Vance has been an outspoken proponent of this idea, saying on X last month that “not having 20 million illegal aliens who need to be housed (often at public expense) will absolutely make housing more affordable for American citizens.”

There’s a certain chilling logic to this idea: Lowering housing demand through mass deportations will lower housing prices as well.

New research however suggests the negative supply effects of kicking immigrants out of their homes outweigh any price declines caused by falling demand for housing. While immigrants consume housing, they also build housing. A recent study found that increased immigration enforcement creates a shortage of construction labor that lowers housing production and increases housing costs.

Corporate Scapegoating

Vance is also an anti-corporate hawk who could well encourage a future Trump administration to adopt any number of counterproductive restrictions on corporate involvement in the real estate industry.

He’s been a frequent critic of institutional investors like BlackRock purchasing and renting out homes, arguing that this deprives ordinary Americans of the opportunity to be homeowners.

“They have access to lower interest rates. They have access to cheaper money, and they completely crowd out the availability for homes for people who want to just buy a piece of their community,” said Vance last year.

But institutional investors’ injection of capital and financing into the housing market is something that makes housing more accessible to ordinary Americans, not less.

Post-Great Recession restrictions on mortgage financing have made it a lot more difficult for individuals and families to finance the purchase of a new home. Institutional investors help mitigate this problem by buying up and renting out homes that Americans couldn’t finance a purchase of their own.

Recent research has found where institutional investors are prohibited from purchasing homes, rental prices increase and lower-income households dependent on rental housing are excluded from exclusively owner-occupied neighborhoods.

Vance has also been a rare Republican proponent of Federal Trade Commission (FTC) Chair Lina Kahn’s aggressive anti-trust agenda, calling her “one of the few people in the Biden administration who I think is doing a pretty good job.”

Under Kahn, the FTC has said that landlords’ use of rent-recommendation software likely amounts to illegal price collusion that drives up rents to above-market rates.

In fact, rent-recommendation software often leads landlords to lower rents faster in the face of falling housing demand. Where this software recommends landlords raise rents, that’s a result of rising demand in markets with tight restrictions on new supply.

The Kahn FTC’s scapegoating of rent-recommendation software for higher rents ignores those market fundamentals. Through his support of Kahn, Vance suggests that he’s fine with that scapegoating.

Quick Links

- Police in Hillsborough, California, sent a letter to the owner of the Bay Area town’s famous/infamous Flintstone House saying that a catered sushi pop-up restaurant at the home violated local zoning restrictions. The town had previously sued the home’s owner, Florence Fang, for adding a bunch of dinosaur statues to the home’s lawn without allegedly getting the proper permits.

- New York City Mayor Eric Adams’ City of Yes for Housing Opportunity gets praise from supporters and heated criticism from opponents at a marathon City Planning Commission hearing. The New York City Council is expected to vote on the mayor’s proposed zoning reforms this fall.

- The New York Times has a long opinion essay on why American elevators cost so much and what this reveals about America’s failure to build.

- Chicago delays a vote on liberalizing accessory dwelling unit regulations.

- State-level reforms in California are reducing the time it takes to permit new homes in San Francisco.