Explore the projected growth of the national debt in the coming decades and learn about the factors contributing to this increase.

During President Joe Biden’s 2023 State of the Union address, the national debt was soaring to unprecedented levels, with the annual budget deficit projected to double from $1 trillion to $2 trillion. This alarming trend was exacerbated by the escalating Social Security and Medicare shortfalls, prompting concerns from economists at the Congressional Budget Office (CBO) and experts across the political spectrum. Despite warnings of a looming debt crisis, political leaders remained divided on how to address the issue, with Biden vowing to protect Social Security and Medicare from any cuts while opposing new broad-based taxes.

The unchecked growth of government debt has become a bipartisan issue, with both Republicans and Democrats endorsing policies that contribute to the escalating debt crisis. In the past decade, trillions of dollars in deficit-expanding legislation have been enacted, further exacerbating the fiscal challenges facing the nation. Despite warnings from economists about the potential consequences of excessive spending, lawmakers have continued on a path of unsustainable borrowing and spending.

The underlying drivers of the national debt are clear: rising healthcare costs and an aging population are causing Social Security and Medicare expenditures to outpace revenues, leading to annual shortfalls that must be funded through borrowing. Without significant reforms to these programs and middle-class taxes, the nation’s fiscal outlook will continue to deteriorate, with interest costs consuming a significant portion of federal tax revenues.

Debt Projections

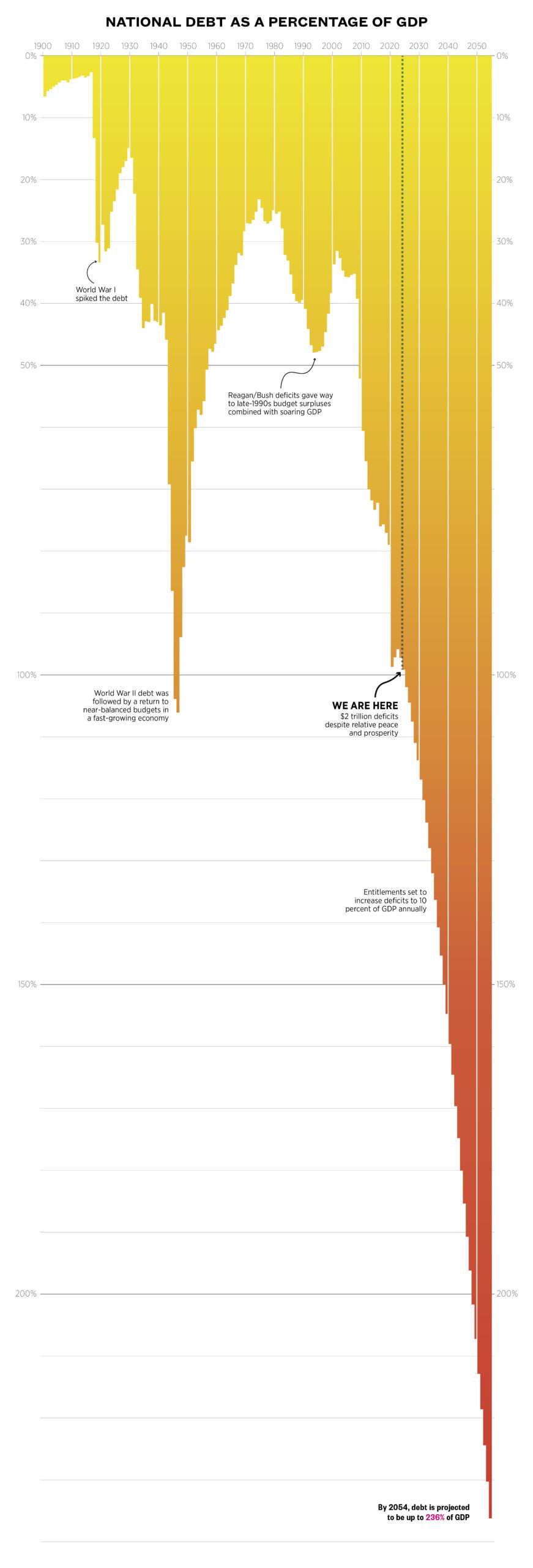

The projected growth of the national debt is alarming, with deficits expected to reach unsustainable levels in the coming decades. If current tax and spending policies are maintained, the deficit could swell to 14 percent of GDP over the next thirty years, leading to a budget deficit exceeding $4 trillion within a decade. Rising interest rates pose a significant risk, with projected interest costs consuming a quarter of all federal taxes within a decade and becoming the largest annual federal expenditure within two decades.

The total federal debt as a share of the economy has already increased significantly and is projected to exceed 230 percent within three decades under current policies. If interest rates continue to rise, the debt ratio could surpass 300 percent, with interest costs consuming nearly all annual tax revenues, leaving little room for funding federal programs.

The unsustainable path of current fiscal policy has raised concerns among economists, with projections suggesting that the economy may not be able to function under the current debt trajectory. The combination of rising healthcare costs and an aging population will continue to drive annual Social Security and Medicare shortfalls, further exacerbating the nation’s fiscal challenges.

In order to address the growing national debt and avoid a fiscal crisis, significant reforms to Social Security, Medicare, and middle-class taxes are essential. Without decisive action, the nation’s fiscal outlook will continue to deteriorate, leading to dire consequences for future generations.

, President Clinton’s former chief of staff, Erskine Bowles, predicted back in 2012 that by 2054, Social Security and Medicare will be contributing 11.3 percent of GDP to annual budget deficits, resulting in a $3.2 trillion shortfall. This crisis, driven by baby boomer retirements, rising healthcare costs, and increasing interest rates, has been deemed “the most predictable economic crisis in history.”

Despite warnings dating back to the 1990s, attempts to gradually implement reforms to Social Security and Medicare have failed, leading to the need for more drastic measures. Stabilizing the debt now requires deeper reforms to these programs, potentially including raising the eligibility age and adjusting benefit growth formulas.

Washington’s reluctance to address these issues is concerning, especially considering the historical significance of deficits in economic policy debates. From the 1980s through the end of the century, deficit reduction was a top priority, with both parties pushing for aggressive measures to cut deficits and spur economic growth.

In recent years, however, deficit concerns have taken a back seat as Washington has continued to increase spending without addressing the underlying issues. The rise of Modern Monetary Theory (MMT) as a justification for massive deficits has only added to the problem, with experts unanimously rejecting its claims.

With the national debt exceeding 100 percent of GDP and projected to double or triple in the coming decades, the era of cheap borrowing is coming to an end. Rising interest rates and structural factors are expected to further exacerbate the debt crisis, yet political gridlock in Washington continues to hinder meaningful reform efforts.

The collapse of bipartisan cooperation in Congress has been a significant barrier to addressing the growing debt crisis. Despite past successes in deficit negotiations, recent failures have highlighted the dysfunction and hyperpartisanship that now plague Washington. If meaningful reform is to occur, a return to bipartisan collaboration and trust will be essential. Lawmakers used to focus on building bipartisan relationships during legislative sessions, but now they fly into Washington only to attack the other party and quickly leave. The media landscape has become fragmented, partisan, and obsessed with narratives of betrayal. Gerrymandered districts make lawmakers more afraid of primary challenges than of losing swing voters in general elections. Most policy making has been centralized in the hands of party leaders, leading to constant partisan warfare where issues are just tools in communication battles.

The deficit has ballooned to unsustainable levels, reaching $2 trillion and possibly heading towards $3 or $4 trillion. Balancing the budget seems impossible without unpopular changes to entitlements and taxes. Both parties avoid tackling the issue due to fear of backlash from their base.

Republicans blame Democrats for deficits, despite evidence to the contrary. They rely on ineffective strategies like cutting foreign aid or social spending, which would not make a significant impact on the deficit. Gimmicks and empty promises are common, such as Trump’s plan to pay off the debt with oil and gas revenues.

Republicans engage in symbolic fights over discretionary spending while ignoring the growing costs of entitlements. The party’s attempts at deficit reduction are mostly gimmicks, distracting voters from their excessive spending. The House GOP’s balanced budget plan is full of empty promises and unachievable goals.

Overall, lawmakers on both sides lack a serious agenda for deficit reduction, resorting to ineffective strategies and gimmicks instead of addressing the root issues. Progressive lawmakers are quick to criticize Freedom Caucus lawmakers for demanding massive spending cuts without providing a detailed plan or engaging in necessary negotiations. Democrats, on the other hand, often downplay the importance of deficits and offer simplistic solutions, such as taxing the wealthy, to address budget shortfalls. However, the math shows that tax cuts for the rich are not the primary driver of deficits, and simply raising taxes on high earners and corporations is not a feasible solution to the fiscal challenges facing the country. Democrats need to move beyond easy fixes and engage in more thoughtful and realistic discussions about how to address the nation’s budgetary issues. Pramila Jayapal from Washington promises significant efficiency savings without detailing a new provider payment system to achieve them. Instead, the bills delegate the responsibility of figuring out the logistics to someone else. Economists estimate that any efficiency savings would likely be used for expanded benefits, keeping national health expenditures relatively unchanged. Furthermore, no adequate “Medicare for All” tax has been proposed to replace the $3 trillion in annual private health spending that would be nationalized. It is also crucial to note that these proposals would not impact Medicare’s projected $87 trillion three-decade shortfall as old-age Medicare already pays lower provider rates similar to Medicare for All.

There are bipartisan myths surrounding Social Security and Medicare, such as the belief that they cannot legally run deficits, that most seniors are impoverished, and that retirees only receive benefits equal to what they paid into the systems. In reality, these programs are projected to run a combined deficit of $650 billion this year, senior incomes have increased significantly compared to worker incomes since 1980, and most retirees receive benefits that exceed their lifetime contributions.

It is essential to address the fiscal lies and myths surrounding Social Security, Medicare, and middle-class taxes. Lawmakers and presidential candidates are aware of the unsustainable fiscal situation but often avoid discussing it publicly due to the challenging politics of deficit reduction. Voters play a significant role in this by opposing real deficit reforms in favor of unrealistic solutions and making contradictory fiscal demands. Ultimately, it is crucial for both parties to work together and address the looming fiscal insolvency to avoid a future debt crisis. With budget deficits projected to exceed $2 trillion and potentially surpassing $3 trillion within the next ten years, is anyone willing to take action to prevent this? This article was originally published under the title “The Debt Lies We Tell Ourselves.”

Source link