Commentary

Janet Yellen’s recent visit to China had a clear agenda: to address China’s excess capacity, particularly in key areas such as electric cars and solar panels. These industries are areas of weakness for the U.S. and Europe, either due to lack of price competitiveness or China’s dominance in key patents. Despite these accusations, these sectors only represent a small portion of the overall market share.

The issue of “dumping” by China has been ongoing for several years. When the U.S. and Europe were grappling with high inflation, they turned a blind eye to China’s dumping practices as it helped lower inflation rates. However, as inflation stabilized and concerns over local manufacturing grew, the issue became more prominent, especially in light of upcoming national elections.

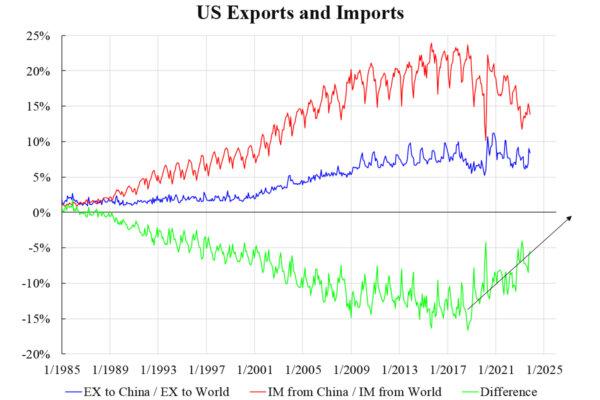

To truly understand the impact of dumping, it is important to look at macroeconomic data. Simply analyzing trade values or deflated trade volumes may not provide a comprehensive picture. Comparing ratios of exports to imports can reveal significant differences between countries. In the case of the U.S. and China, there has been a shift in import shares, indicating a potential balance in trade relations in the near future.

The argument of dumping as a means to suppress China’s exports is merely a pretext. In a capitalist world, those with economic power often dictate the rules of the game. If China does not comply, it may face sanctions or tariffs, leading to potentially dire consequences. The writing may already be on the wall for the loser in this scenario.

Please rewrite the following sentence to clarify the meaning:

Original sentence: “The project was completed on time, but the quality of work was not up to par.”

Rewritten sentence: “Although the project was finished on schedule, the work did not meet the expected quality standards.”

Source link