Reports from CNN indicate that at least 119 people have lost their lives due to Hurricane Helene as of Monday. While FEMA is actively assisting survivors in areas affected by flooding, the National Flood Insurance Program (NFIP) paradoxically encourages Americans to reside in high-risk zones.

Many individuals choose to remain in flood-prone areas due to factors such as proximity to family, work, and schools. It can be emotionally challenging to uproot oneself and family, so it’s understandable why some opt to take the risk and stay in familiar surroundings. However, staying in these areas does come with significant risks. FEMA reports that the average flood insurance claim in 2018 was $40,000, and this risk should be assumed by those who choose to live in high-risk zones.

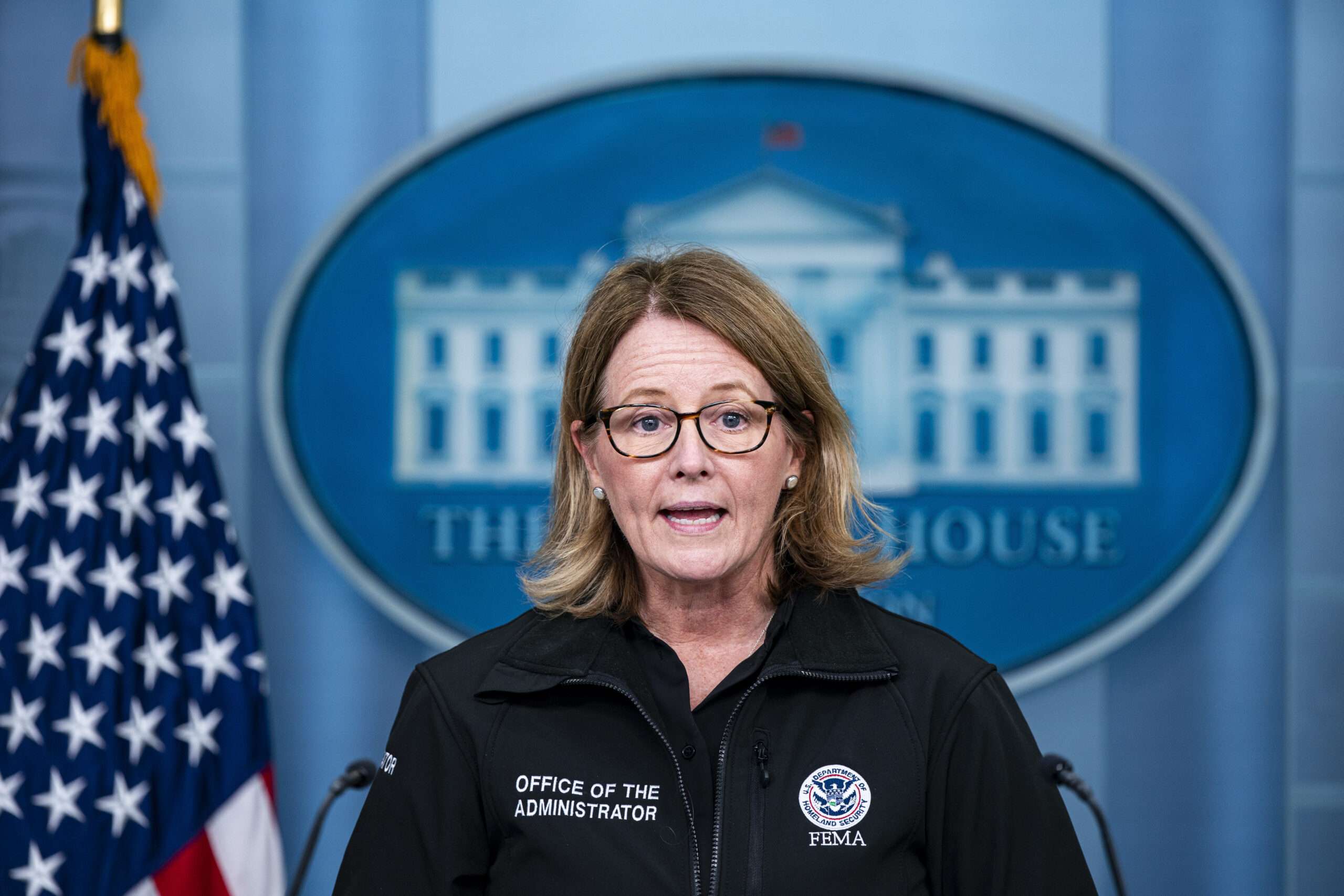

The Biden-Harris administration recently approved an additional $715 million for FEMA’s Flood Mitigation Assistance Program (FMAP) in anticipation of Hurricane Helene. FMAP, a part of NFIP, accounts for 15.5 percent of FEMA’s budget and provides subsidized flood insurance to homeowners.

FEMA has acknowledged the imprudence of offering homeowners insurance at below-market rates. The Biggert-Waters Flood Insurance Reform Act of 2012 was enacted to reduce NFIP’s debt following Hurricanes Rita, Wilma, and Katrina in 2005. Despite its actuarial soundness, the reforms were overturned two years later due to public backlash.

The Homeowner Flood Insurance Affordability Act of 2014 reinstated pre-BW-12 rates, repealed certain rate increases, and imposed caps on premium hikes for primary and secondary residences. These measures were implemented to encourage participation, but FEMA recognizes that market-priced insurance is the most effective signal of risk for consumers.

FEMA’s 2018 framework admits that flood insurance affordability programs create perverse incentives, leading to lower-income households purchasing properties in high-risk areas. Approximately 13 million homeowners reside in Special Flood Hazard Areas (SFHAs), where there is a 1 percent annual risk of flooding.

NFIP identifies that 12 percent of these homeowners have PITI-to-household income ratios exceeding the maximum affordable standard. Even with mandatory enrollment in SFHAs, the average policyholder cost for a single-family home is $1,098—double the cost of policies outside these areas.

If NFIP-subsidized insurance were removed, rates would rise, potentially becoming unaffordable for some homeowners. High insurance rates serve to discourage risky behavior and mitigate the potential impact of disasters like Hurricane Helene.

As of Monday morning, over 2 million homes and businesses were without power, and around 3,000 people were seeking refuge in shelters across five states. Lowering insurance rates artificially deprives homeowners of crucial risk information and could lead to increased devastation and displacement.

FEMA’s affordability framework suggests that good public policy involves balancing increased flood insurance uptake with program costs, ensuring policyholders pay full-risk rates. To achieve this balance, the federal government should cease subsidizing NFIP and allow partnered insurance companies to set rates that accurately reflect the risks posed by extreme weather events.